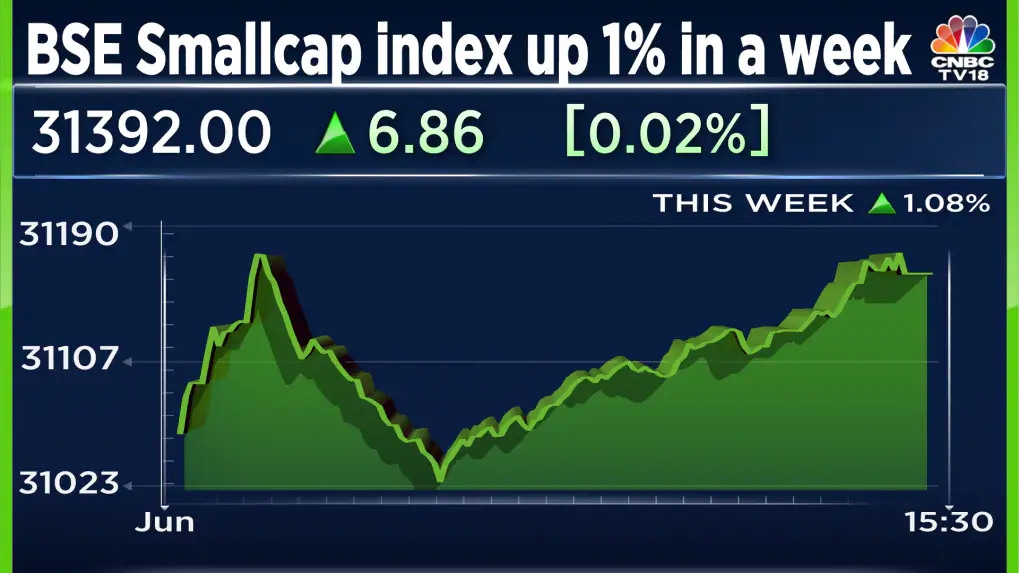

There are a lot of things you need to know as an investor since the market is rather complicated, and you need to have a better grasp of how you evaluate the opportunities presented by the stocks that are on the market. Since they offer data on market performance and trends, stock market indices are essential tools for investors. If we talk about BSE Smallcap, in a nutshell, it is a component of the S&P BSE All Cap Index. It tracks the performance of the tracks and the performance of all the small-cap stocks listed on the Bombay Stock Exchange. It has one more advantage, and that is that it helps all the investors out there to be exposed to the small-cap sector of the market, which can offer them growth opportunities. As we go further in this blog, we will investigate the comprehensive opportunities offered by the BSE Smallcap Index.

Significance of the BSE Small Cap Index

As we discussed above, the BSE small-cap index helps represent the performance of the small-cap stocks that have been listed on the Bombay Stock Exchange. Not only does it allow exposure to all the investors to all those companies that have smaller capitalization, but they also have higher potential in the future. If you were an investor, you would want to put your money into growth-oriented stocks. In terms of its past, it was introduced in 2005. Its primary purpose, upon inception, was to monitor the performance of small-cap companies in India. You might see all the larger companies that have been in the market and are ready to be analysed, but what about their smaller counterparts? Well, this is where the need for this index came into the picture. Often, small companies are overlooked, but under this index, the focus will be largely on such small-cap companies. The significance of this index cannot be overlooked. With this, investors can gain insights into the emerging trends of the index, its growth potential, and other opportunities in the market.

Investment opportunities

However, there are numerous risks associated with the stocks for investors. Depending on your risk tolerance and other essential factors such as volatility and sensitivity, the investment opportunities are huge here as well. Truth be told, when you invest in small-cap funds, you have to deal with higher risks. There are various other things, such as diversification, that may help you lower your risk tolerance. Despite various risks, small-cap stocks have growth opportunities for investors out there. Although there is much potential for you, it is advisable to invest wisely in the stocks with thorough knowledge. Keep yourself updated on every financial news story. Whether it is a piece of trivial news or not, it might be beneficial for you.

Conclusion

In conclusion, BSE Small Cap Index stocks have the potential for growth opportunities, and with Nifty chart, you can make sure what exactly is happening with the stocks. Depending on the performance, you are free to invest wherever you see the future for your finances. However, you need to be a little more attentive to the dynamic nature of the market.